This company is amazing. They are really responsive and quickly address my concerns with our rental. I have been working with Juan Escobedo and he always keeps me updated on my work orders. Mynd is lucky to have him as an employee. He gets the 5 stars.

Your one-stop shop to

single-family rental investments in 25+ US markets

FEATURED IN

Invest smarter. Earn more. Stress less.

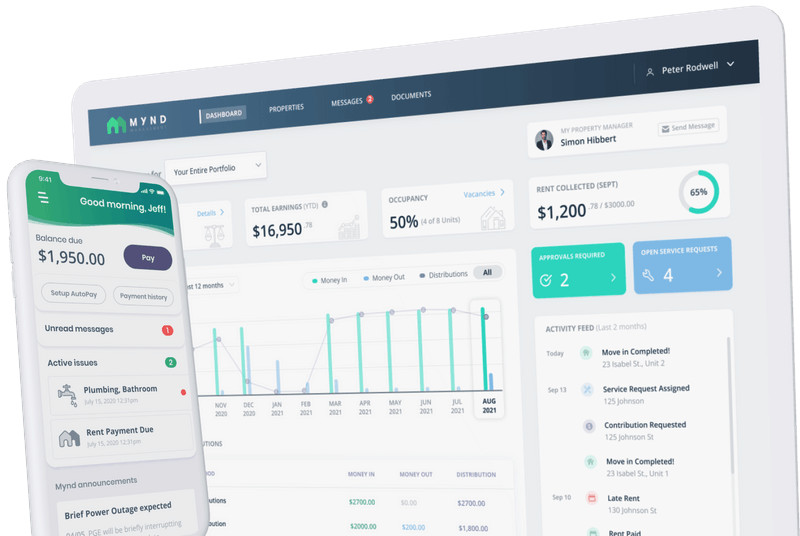

Mynd is the first and only end-to-end real estate platform that helps investors find, buy, lease, manage, and sell residential investment properties. Our integrated tech + services model allows you to build and manage a portfolio remotely, from anywhere in the world.

Buy

Savvy real estate investors buy single-family rental properties with Mynd. Gain access to investments in top markets throughout the U.S. that tap into historically safe, stable, and profitable real estate returns. We use over a decade of SFR experience and deep-data analysis on rents, renovation and maintenance costs to find the highest-performing real estate investment opportunities, including off-market exclusives and MLS properties. Whether you’re buying your first property or building a real estate portfolio, we’ll help you find the perfect match for your long-term goals and guide you every step of the way.

Finance

Mynd Mortgage is a full-service mortgage brokerage and subsidiary of Mynd. We work with lenders nationwide to select the loan that is right for your investment goals and investing history. From purchasing to refinancing, our goal is to unlock your ability to build wealth through lending that is fast, fair, and transparent.

Manage

Mynd portfolio managers and technicians provide residents with white glove property management: inspections, showings, move-ins, repairs & maintenance, rent collection, landscaping, and more. You’ll have full visibility into all communications and full control over all spend, right from your owner dashboard or mobile app. Mynd’s scale and expansive network of vendor partners means we can pass our savings on to you. Our Peace of Mynd guarantees protect you against unforeseen expenses due to damage, vacancies, delinquencies, and evictions.

Sell

We leverage local agents, networks, and infrastructure in 25 markets, plus big data models and comps, to ensure you get the maximum possible sale price for your property—whether from another Mynd investor or a new homeowner in the local market.

Where Mynd operates

Select your location

In great company

Headquartered in Oakland’s vibrant Uptown district, Mynd is backed by top investment and venture capital firms specializing in fintech and proptech. Our management team hails from leading real estate and technology companies, including Starwood Waypoint Homes, McKinsey, Shift, Better, BCG, One Medical, Zillow, WeWork, Upwork, and Facebook.

What real estate investors are saying

Yes I've had a great experience with Mynd Especially with getting things fixed in property. The moment I submit a work order I automatically feel confident because I know the job is going to get done, and Chad always makes sure I'm comfortable with the work and that I'm satisfied , and all I want to say is KEEP UP THE GOOD WORK!!!!

When investing in rental properties, Mynd's services are superb! Mynd reps help locate, analyze, and guide you through the entire process. They are there for you, the investor! Thanks again Todd for your outstanding service for helping me locate and purchase my properties...

Michael was very helpful in arranging for me to view several properties on the same day to minimize my searching time. He asked questions to confirm that I had the necessary information available to make the proper decision on selecting a rental property. Booking an in-person tour was simple!

Willie P. Has been such an integral part of our settling into our new home. Upon moving in there were a couple issues that needed to be fixed and Willie had them serviced right away with a quick turnaround time and zero friction. He’s been incredibly communicative and patient and helpful during the process and without him none of these maintenance issues would’ve been addressed as quickly. He had everything fixed in a timely manner and responded to any and every questions we had along the way. He’s been our primary source of truth and he deserves five stars for all the work and time he’s put into helping us settle into our new home. Thanks Willie!

I haven't been with Mynd for very long, but they have seemed to impress me thus far. We had an issue with our heat not working. I contacted Mynd through their app, and had a quick response from one of their representatives. That representative was Napoleon Fernández. He was fantastic! He got someone to come out as quickly as possible. That someone was Stephen from Comfort Services. Stephen fixed our heat and made sure everything was working properly before leaving. During all this, Napoleon stayed in contact making sure that the problem was being solved. I can't thank these two enough for their hard work to ensure that we were taken care of.

Mark Cabaluna has been super helpful and very responsive regarding every issue no matter how small or quick of a fix. I’m truly thankful for her help and continue support.

Reported an issue with my A/C and Chad Santos responded in a very prompt and timely manner. He scheduled a vendor to make the repairs and everything was done within a day and a half. Great service and very professional.

I was so impressed with my customer service rep, Mark D. I was at a house, it was dark, and I couldn’t open the lock box. I called the number provided for “problems." Mark D. Answered right away. He was extremely polite, kind, and helpful. I got in within minutes. Mark stayed on the phone with me for a while. I was a little nervous being in the house with it so dark outside. He answered questions and was just very pleasant! Thank you Mark!

I found Mynd while doing an online PM search. The things that really attracted me to this company were their assurances and additional guarantees offered in their top package. They are a full service property manager, so they handle everything which makes my life a lot easier. Amy Perry had done a good job communicating to me when needed during on boarding and ongoing management issues. Danni was professional on the phone and was helpful and responsive to recommendations I gave them. I would recommend Mynd to anyone looking for a Property Management Company.

Ready to speak with our sales team?

Looking to invest in a rental property?

Don’t be a stranger

Keep SFR investing top of mind by subscribing to our our monthly newsletter. No spam. We promise.